Form 720 Instructions - Simplified

What is Form 720?

Form 720, officially titled "Quarterly Federal Excise Tax Return," is used to report and pay various Federal Excise Taxes. It is filed quarterly and applies to specific activities or products subject to Excise Taxes.

Importance of Following the Instructions for Form 720

Form 720 includes detailed instructions to ensure accurate reporting and compliance. Precision is crucial in tax filings, and following these guidelines helps prevent errors and penalties. The IRS stresses the importance of adhering to these instructions for a smooth and hassle-free tax filing process.

What is Form 720 Used For?

Form 720 serves more than just revenue collection; it is a regulatory tool that influences consumption for public welfare. By imposing taxes on specific goods and services, the government aims to regulate their usage.

Timely and accurate filing of Form 720 is not just a legal requirement—it demonstrates compliance with federal regulations, helps avoid penalties, and reduces audit risks. The revenue generated supports public services and government programs.

Who files Form 720?

Form 720 applies to a diverse range of businesses, including sole proprietorships, partnerships, corporations, and limited liability companies.

-

Manufacturers and Producers:

Businesses involved in the production or manufacturing of goods, such as alcohol, tobacco, firearms, and specific fuels. -

Retailers:

Retailers selling products subject to excise taxes, such as alcohol, tobacco, or certain fuels. -

Importers and Distributors:

Entities involved in importing goods subject to excise taxes or distributing taxable products. -

Providers of Services:

Businesses providing specific services, such as communication services (e.g., telephone services), air transportation services, or environmental-related services. -

Environmental Taxes:

Businesses engaged in activities with environmental implications, such as the production and importation of ozone-depleting chemicals. -

Fuel Producers and Sellers:

Entities involved in the production, sale, or use of certain fuels.

It's essential for these entities to review IRS regulations and guidelines, along with the specific instructions provided with Form 720, to determine their reporting and payment obligations accurately.

Consulting with tax professionals like Simple 720 can ensure compliance with applicable tax laws.

720 Online vs. Paper Filing

When it comes to filing Form 720, businesses have two options: online or paper. Let's break down the key differences between the two:

A. Online Filing

If you're considering the digital route, you can file Form 720 online through various electronic platforms participating in the IRS e-file program for excise taxes.

This method has several advantages—it's fast, efficient, and generally more accurate than traditional paper filing. However, there’s a catch—you must use IRS-approved e-filing software, and some of these services may charge a small fee. On the bright side, you gain access to convenient electronic payment options, such as direct debit or credit card. Plus, the best part is the immediate confirmation and tracking of your submission, giving you peace of mind.

We’re here to help! Simple 720 makes Form 720 excise tax filing easier and more efficient. You can complete your filings in just a few minutes through our portal—no need to remember all the schedules. Reduce errors, cut administration costs, and simplify your federal excise tax filing by moving online today!

Simple 720 IRS Form 720 eFilingB. Offline Filing

If you prefer a traditional approach, you can obtain a physical copy of Form 720 from the IRS or a local office and mail it back. However, this method is slower and less convenient compared to online filing.

Filling out the form manually increases the likelihood of errors. When it comes to paying your tax liability, checks or money orders are the primary options. Unlike online filing, you won’t receive immediate confirmation or tracking.

Ultimately, the choice is yours. But here’s a tip—the IRS encourages online filing because it’s faster, more accurate, and offers the convenience of electronic payment options.

Going digital can make your tax filing experience much smoother!

IRS Form 720 PDFHow to fill Form 720 as per IRS 720 Instructions manually?

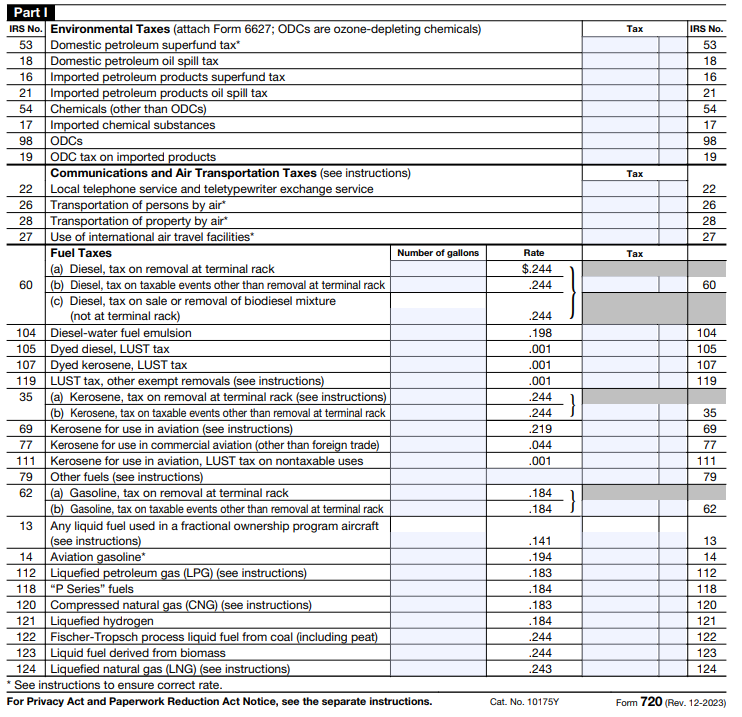

Part I

This section outlines excise taxes applicable for the current quarter on a range of products and services, including fuels, air transportation, communication, environmental, retail, ship passenger, foreign insurance, and manufacture taxes.

Source: IRS

Reporting involves specifying the tax liability by IRS number and indicating the amount of tax owed for each item.

To complete Part I, follow these steps:

- Identify the IRS numbers related to the activities, goods, or services for which you are responsible.

- For each IRS number, input the taxable amount, rate, and tax in the appropriate columns. If there are multiple rates for the same IRS number, use separate lines for each rate.

- Sum the tax amounts from all lines and record the Total(1).

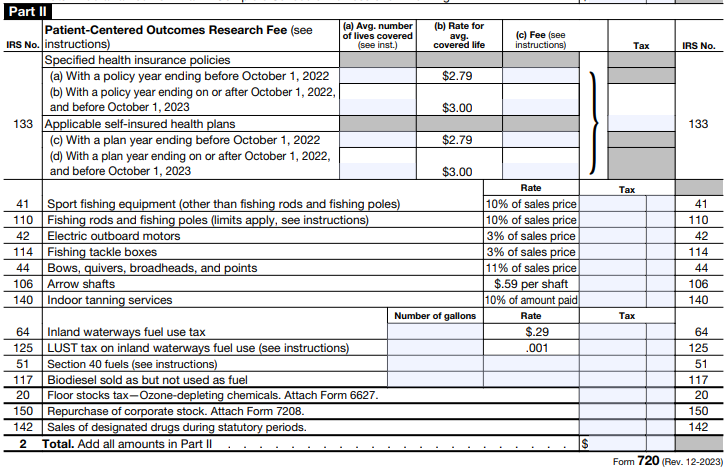

Part II

This part details excise taxes for the current quarter linked to the sales or use of particular products, such as Patient-Centered Outcomes Research Fee, sport fishing equipment, bows and arrows, indoor tanning services, and more.

Similar to Part I, reporting requires the disclosure of tax liability by IRS number, along with the respective amounts due for each item.

- Identify the corresponding IRS number for the tax you are reporting. IRS numbers can be found in the Form 720 instructions.

- Add all amounts in Part II in Total(2).

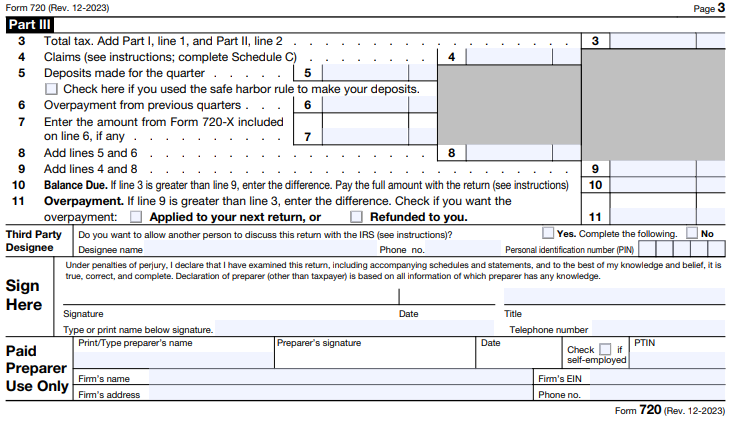

Part III

Reserved for reporting excise taxes from previous quarters that were not disclosed on a prior Form 720. Reporting involves specifying the tax liability by IRS number, indicating the quarter in which the liability was incurred, and specifying the amount of tax owed for each item.

To complete Part C, follow these steps:

- Sum up the Total(1)+ Total(2) in line 3.

- To complete line 4, You should have completed Schedule C. To complete Schedule C, you must have completed Schedule A or T.

- Complete column 5-7 wherever necessary. Finally, you end up with due or overpayment.

Feeling exhausted from manual filing? Then, move it online and complete it in a few minutes.

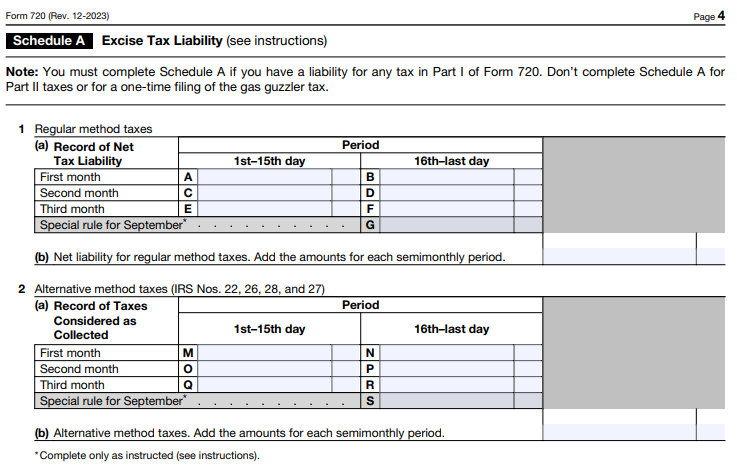

File Your Form 720 Online Schedule A

Excise Tax Liability is a section of IRS Form 720 that reports the net tax liability for specific excise taxes.

This schedule is mandatory for businesses with a tax liability in Part I of Form 720, typically paid bimonthly.

Businesses without Part I liability but with Part II liability don't need to fill out Schedule A.

It details the excise tax liability for each semimonthly period and the total net liability for regular and alternative method taxes. Regular method taxes are based on sales or use, while alternative method taxes are based on the tax amount considered collected from the payer.

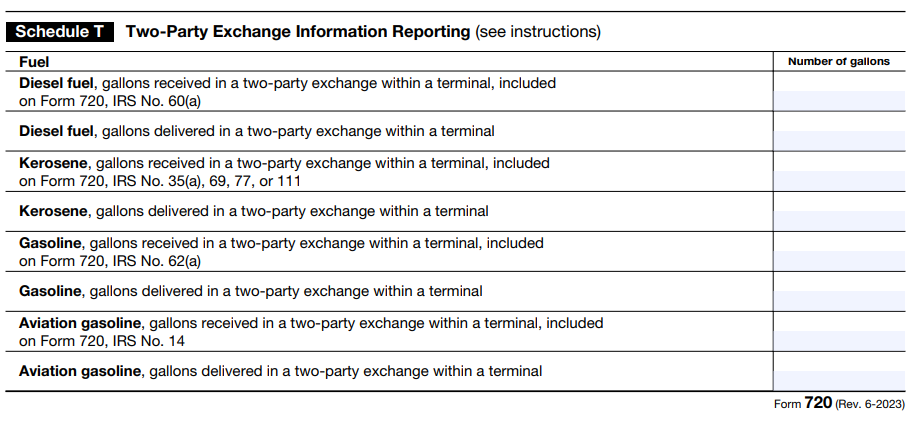

Schedule T

Two-Party Exchange Information Reporting is part of Form 720, a quarterly federal excise tax return. It reports gallons of specific fuels in a two-party exchange within a terminal.

This exchange involves transferring taxable fuel from one holder to another, where the delivering party isn't liable for the tax. The receiving party, liable for the tax, reports on Schedule T and Form 720. Schedule T has columns for diesel fuel, kerosene, gasoline, and aviation gasoline.

The taxpayer records gallons received and delivered, ensuring totals match Form 720. Schedule T aids the IRS in verifying excise tax reporting accuracy and preventing double taxation or underreporting.

Fill up the applicable columns and move to Schedule C

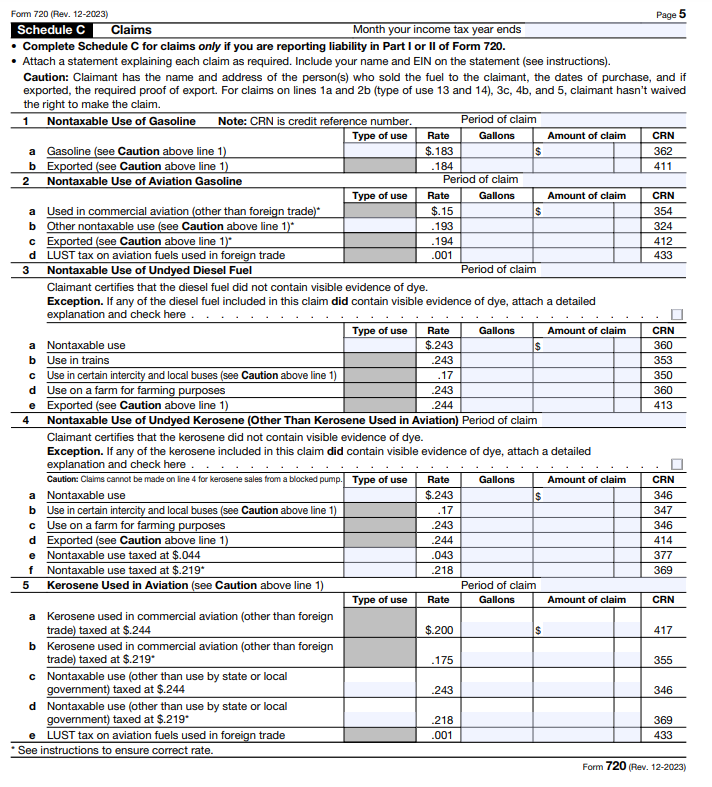

Schedule C

Complete Schedule C for claims only if you are reporting liability in Part I or II of Form 720.

Similar to Schedule T, Schedule C is relevant for businesses involved in the specified fuel types.

If you're responsible for taxes in either Part I or Part II, you could potentially reduce your tax liability by submitting a claim through Schedule C. It's important to note that not all fuel types and usage scenarios qualify for a Schedule C claim, and the IRS specifies the eligible use types for such claims.

- Nontaxable use of gasoline, aviation gasoline, kerosene, diesel fuel, and alternative fuel (lines 1–6).

- Biodiesel sold as, but not used as, fuel (line 7).

- Sales by Registered Ultimate Vendors of Undyed Kerosene (line 8).

- Sales by Registered Ultimate Vendors of Kerosene For Use in Aviation (line 9).

- Claimant sold the gasoline/aviation gasoline at a tax-excluded price (lines 10-11).

- Biodiesel or renewable diesel mixtures(line 12).

- Alternative Fuel Credit and Alternative Fuel Mixture Credit(line 13)

- Other General Claims(line 14).

Fill in your claims at the appropriate sections, totaling them at Line 15.

Once done, insert the claim amount into Line 4 of Part III. Complete the Part III computation before proceeding to Payment Voucher V.

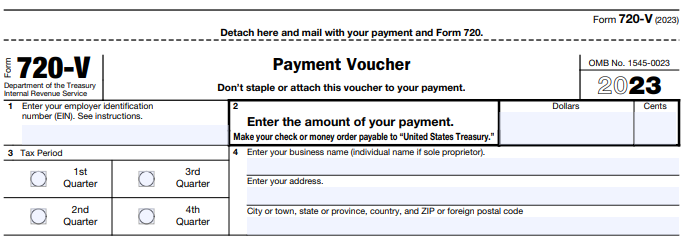

720 V - Payment Voucher

Fill your EIN, amount to be paid, tax period, and business details.

If you're paying your taxes by check or money order along with Form 720, use Form 720-V for a quicker and more accurate payment process. If a third party prepares your return and payment is needed, give them this voucher.

Don't use Form 720-V if you're paying the balance due on line 10 of Form 720 through EFTPS.

Manual Filing seems complex? File your 720 Online with us today!

File Your Form 720 OnlineUtilizing IRS Approved 720 efile Software for Seamless Filing

Harnessing the power of online platforms and tools brings a wave of convenience to the electronic filing of Form 720. Here's a breakdown of the advantages and available options:

E-filing Form 720 online is convenient. Here's why:

- Faster Processing: Say no to snail-paced processing. E-filing speeds up the entire submission process.

- Fewer Errors: Digital filing reduces the likelihood of errors that can creep in during manual filing.

- Instant Confirmation: No more wondering if your forms reached the right hands. E-filing provides instant confirmation of receipt.

- Effortless Calculations: Smart software like Simple 720 handles real-time calculations as soon as you enter the basic details, streamlining your tasks and eliminating unnecessary complexities.

- Utilizing online filing platforms and leveraging automation not only makes Form 720 submission more efficient but also enhances accuracy and compliance with tax reporting regulations.

Form 720 Due Dates

Excise taxes are due every quarter. Here are the form 720 due dates you must remember.

- Excise taxes are due every quarter. Here are the form 720 due dates you must remember.

Avoid Penalty by filing on time

Filing Form 720 on time isn’t just a duty—it’s a smart move to keep your business running smoothly. Missing the deadline can lead to penalties and audits, while timely submission ensures financial stability.

Beyond avoiding complications, filing on time may also make you eligible for tax credits, especially for manufacturers and importers. Plus, it helps build a trustworthy reputation, making your interactions with government agencies smoother.

Stay on track by filing promptly and accurately to ensure a hassle-free tax experience.